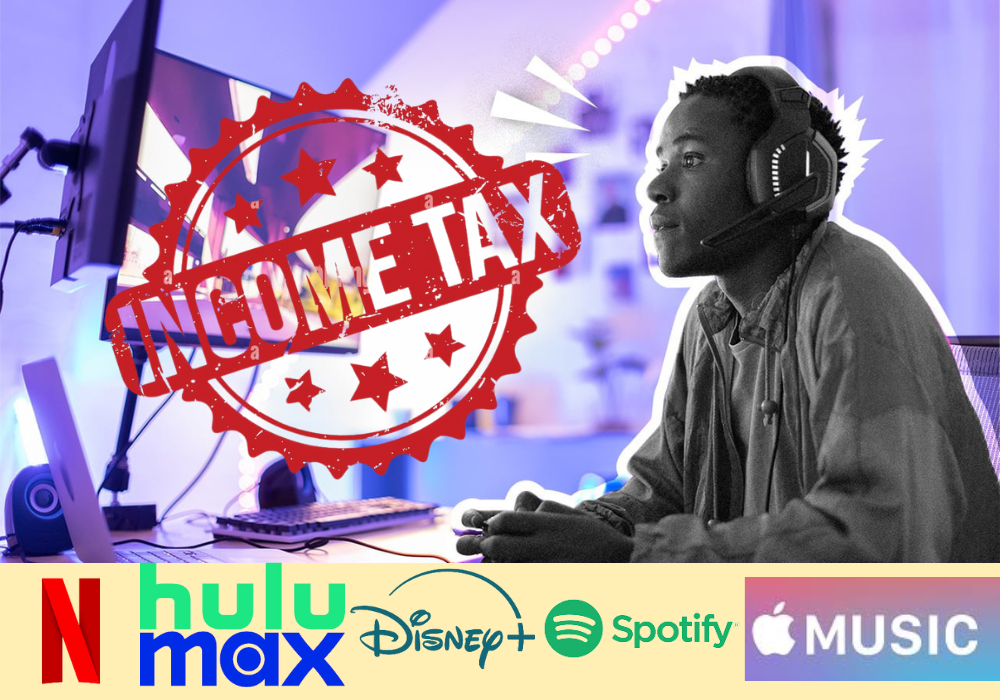

takes the first step toward taxing digital streaming services. New house bill taxes digital products.

Anyone in Louisiana who subscribes to virtual streaming carriers including Netflix, Disney+, or Hulu will eventually see their bills increase as part of Gov. Jeff Landry’s package deal to reshape state taxes.

The Louisiana House Ways and Means Committee advanced House Bill 8 without a contest Monday. It applies the country’s income tax to numerous virtual services and products, including online data subscriptions, video, video games, and cellphone applications. Zoom-integrated communication tools can be extra taxing.

The state currently taxes downloads of digital books, films, and tracks, treating them as tangible goods. The creator of the idea, Rep. Ken Brass, D-Vachery, said 44 states already tax digital services, making it a smooth transition for companies to collect and remit sales tax to Louisiana.

Ways and Means Member Rep. Rashid Young, D-Homer, called Louisiana’s move to tax virtual services a response to changes in the marketplace.

“Blockbuster used to exist in a physical form. You could move and rent a DVD … but because of the growth of the marketplace, we now try it in a virtual form,” Young said.

Items excluded from the bill include stocks and bonds, internet services and any specialist offering that is carried electronically – including telehealth and banking. Internet services and digital telecommunications are already taxed separately under state laws!

The Legislature’s fiscal staff runs a 4% sales tax to calculate how much a good deal sales brass should generate annually, though Landry’s tax plan is zero. Renewed the 45% transitory sales tax that will expire on June 30, 2025. Although it is predicted that the new tax could generate about $40 million annually, some lawmakers on the committee know the low estimate.

ATON ROUGE, La. (WAFB) – Gov. Jeff Landry is trying to lower your income tax, but the catch is that you may end up paying more for things you buy online.

It became a topic of dialogue in the House Ways and Means Committee on Monday, November 11. The secretary of the Department of Revenue, Richard Nelson, says it’s all about simplifying the tax code, and that’s just one of the ways he’s delivering. Pay for the expected revenue loss from that tax cut.

“We’re no longer in a ‘cracker-barrel’ economy where people are just shopping for rocking chairs and hammers,” Nelson said. “You download content online; You don’t go to Blockbuster to rent it anymore. You do these online downloading and online streaming services Video games are all online and software programs are online, so we’re looking to replace the code to keep up with the times.”

Physical items you buy online are already taxed. It’s the virtual commodity that the Landry administration is trying to capitalize on.

Some House Democrats have questions about how the plan affects consumers. Representative Matthew Willard has been one to push back on those proposals.

“If this shipment is avoided and regulated, you can assume that many of these virtual goods will be taxed,”

Willard said.

- Netflix

- Hulu

- Max

- Disney Plus

- Spotify

- Pandora

- Apple Music;

All of them will now have to pay sales tax.

The Department of Revenue estimates that this digital tax will bring in $100 million in revenue.

The thing is, several of these streaming services already have a voluntary income tax rate on your subscription, so while it’s in, the Legislative Fiscal Office, which resolves lawmakers, says the state will provide the easiest at $40 million.

“Some of these online companies already price your sales tax so the real discrepancy changes,” Nelson said. “The Legislative Fiscal Office said that a variety of people are already charging sales tax, so, you won’t get as many sales. So, I think by creating a standard definition and including all those digital products, it’s easier and all the companies are dealt with nicely.”

The state government is already facing a fiscal deficit of about $800 million over the next few years. When you factor in the loss of sales from Landry’s plan to cut personal and company income taxes, Representative Willard and various House Democrats worry about how the cash trickles down the road.

“If the numbers are off by a little bit, it can throw the whole plane into a tailspin, leading to either tax increases for people and companies or deficits for the state of Louisiana, causing us to cut even more spending,” Willard said.

Special consultations on tax reform run through Thanksgiving. As of now, this shipment has not come to the floor of the house.

For more detailed information.

learn more……..

2 Comments

amon kicu hole to amr onek bipode pore jabo.

gotona ki soto vai?

hm vai ata bangladeshar jono na, just USA.